For founders navigating the complexities of operating a business, understanding value-added tax is crucial. Numerous may misjudge the importance of precise VAT assessments, considering them as a burdensome obligation rather than an important part of business finance. Neglecting VAT can lead to grave repercussions, impacting financial stability, tax compliance, and the viability of the enterprise.

As businesses grow, the potential losses rise, and the consequences of incorrect VAT calculations can become critical. Ranging from fines enforced by revenue officials to the possibility of compromising reputation and customer trust, the unseen implications of ignoring VAT should not be underestimated. Utilizing a trustworthy VAT assessment tool can simplify this task, ensuring that founders are both compliant and aware of their responsibilities. Ultimately, comprehending the details of VAT is not merely about adhering to the law; it is essential for safeguarding the longevity of the enterprise.

Grasping VAT and The Importance

VAT, frequently known as VAT, is a tax on consumption imposed on the value added for services and goods at every stage in the production process or distribution. For entrepreneurs, comprehending VAT remains essential since it influences price points, cash flow, along with in the end, the financial outcome. Failing to factor in VAT can cause significant monetary issues, such as sanctions and increased business costs.

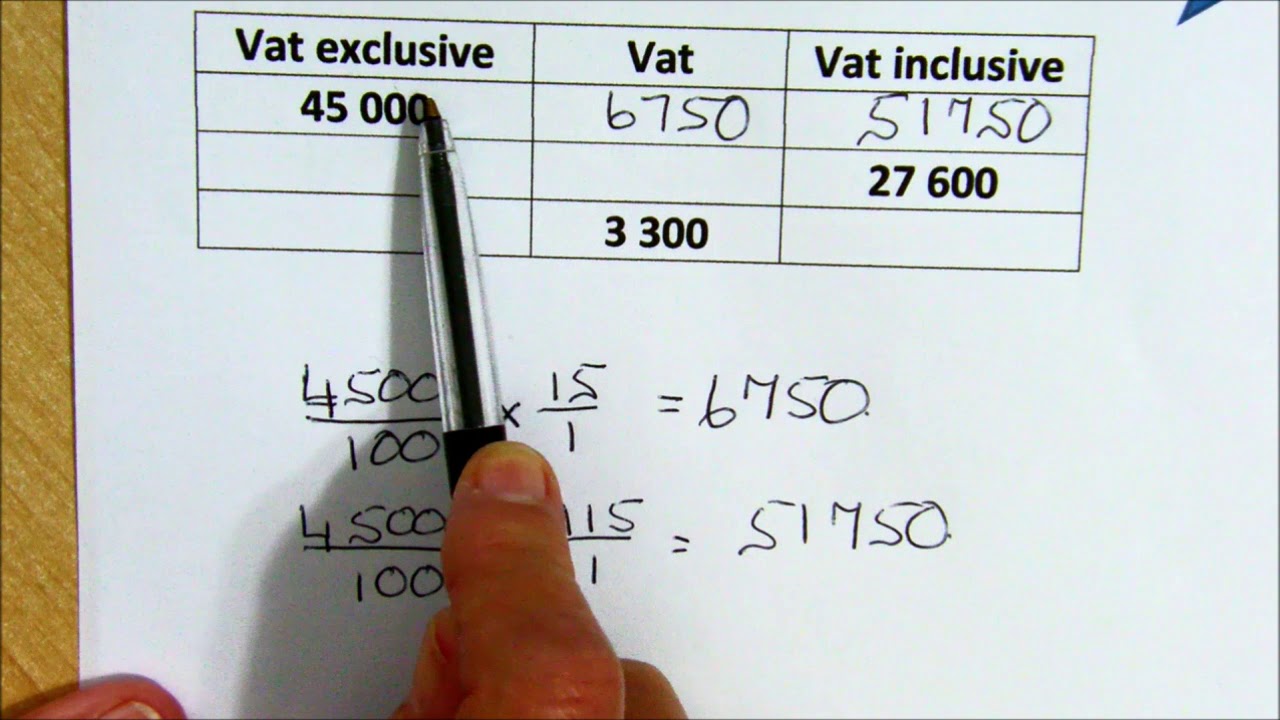

Computing VAT precisely ensures conformity with tax laws, that are necessary for upholding a strong rapport with tax offices. Entrepreneurs need to be meticulous in tracking VAT from their sales and acquisitions to avoid mismatches that might cause inspections along with penalties. Using a vat calculator can ease this process, making it easier to determine the accurate amounts payable along with refundable.

Moreover, comprehending VAT enables firms to determine pricing their items competitively even as fulfilling their tax responsibilities. Business owners who overlook VAT assessment risk underpricing their products, that can diminish profit margins resulting in create unforeseen tax liabilities. By incorporating VAT into considerations in their financial strategies, businesses can enhance their strategic decisions and secure long-term viability.

Common Mistakes in Value Added Tax Computation

One of the primary common mistakes entrepreneurs make is not record every sales and purchases that are subject to VAT. Often, companies only log transactions they deem important, ignoring minor transactions or ones that could qualify for VAT credits. This oversight can lead to inaccurate VAT submissions and could lead to fines or excess payments of VAT, which negatively impact cash flow.

Another common error is incorrectly applying the VAT rates. Different goods and services can fall under different VAT rates, including regular, reduced, and zero rates. vat calculator ireland use the incorrect rate, either due to confusion over the categorization of their products or simply overlooking changes in tax legislation. This error can significantly affect the final sum owed or refunded, creating potential legal and financial complications.

Finally, failing to utilize available resources like a VAT calculator can lead to significant mistakes in VAT calculations. Many entrepreneurs underestimate the value of using tools designed to simplify this task. By neglecting to leverage technology, they may spend excessive time on hand calculations, increasing the chance of errors and complicating their accounting processes. A VAT calculator can help guarantee precision and preserve important time for business owners.

Consequences of Ignoring VAT Compliance

Neglecting VAT regulations can lead to significant financial consequences for entrepreneurs. Inability to accurately calculate and submit VAT can lead to substantial penalties and punishments imposed by tax authorities. As regulations vary by jurisdiction, companies may find themselves incurring additional costs as they attempt to rectify their non-compliance issues. These monetary strains can erode profits and stress liquidity, hindering overall company growth.

Furthermore, ignoring VAT calculations can damage an entrepreneur's image. Clients and associates expect businesses to function transparently and in compliance with laws. Being marked for VAT non-compliance may raise red flags, causing potential clients to rethink their associations with the business. A damaged reputation can take a long time to restore, leading to long-term consequences beyond immediate monetary issues.

Lastly, persistent VAT violations often leads to increased examination from authorities. A business found to be consistently neglecting VAT obligations may face inspections or investigations, which can be labor-intensive and resource-draining. These examinations not only redirect attention from essential business operations but can also cause stress among investors, further affect the organization’s reliability and credibility in the industry.